tax strategies for high income earners book

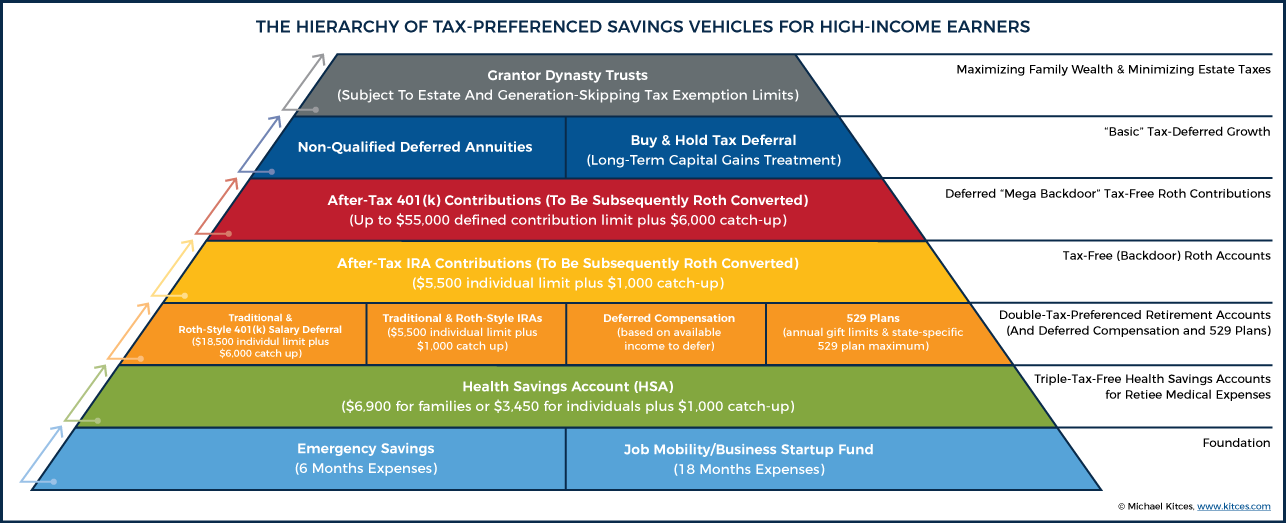

Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners.

Asset Protection For Business Owners And High Income Earners How To Protect What You Own From Lawsuits And Creditors Ebook By Alan Northcott Rakuten Kobo

In 2021 the employee pre-tax contribution limit.

. Mon - Fri. An overview of the tax rules for high-income earners. When you donate to charity you enjoy the privilege of a tax deduction in the year the.

Finance Technology to Improve Analytics for Better Insights into Profit Loss Impacts. Ad Browse Discover Thousands of Business Investing Book Titles for Less. Ad Financial Strategies from EY Can Create a Path Forward and Benefit Your Whole Enterprise.

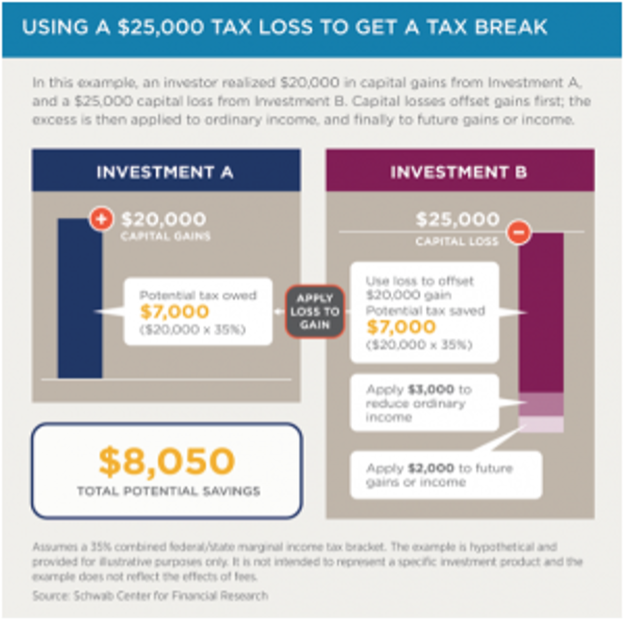

Donating to charity is one of the smartest tax-saving strategies for high-income earners. So the money was distributed to Mary. Well discuss a few tax shelters for high income earners that can potentially help you save millions of dollars if implemented correctly by an expert.

And things are about to get worse if President Biden gets his way. How to Reduce Taxable Income. We will begin by looking at the tax laws applicable to high-income earners.

Take Advantage of Roth IRA. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

Ad Download the free guide learn more about the 6 crucial post-retirement income streams. Ad Best Average Rating For Customer Support. For instance the 2017 Tax Cuts and.

Tax Planning Strategies for High-income Earners. Thats especially true if you earn more than 400000 as. Get our free guide discover 6 sources of post-retirement income you should know.

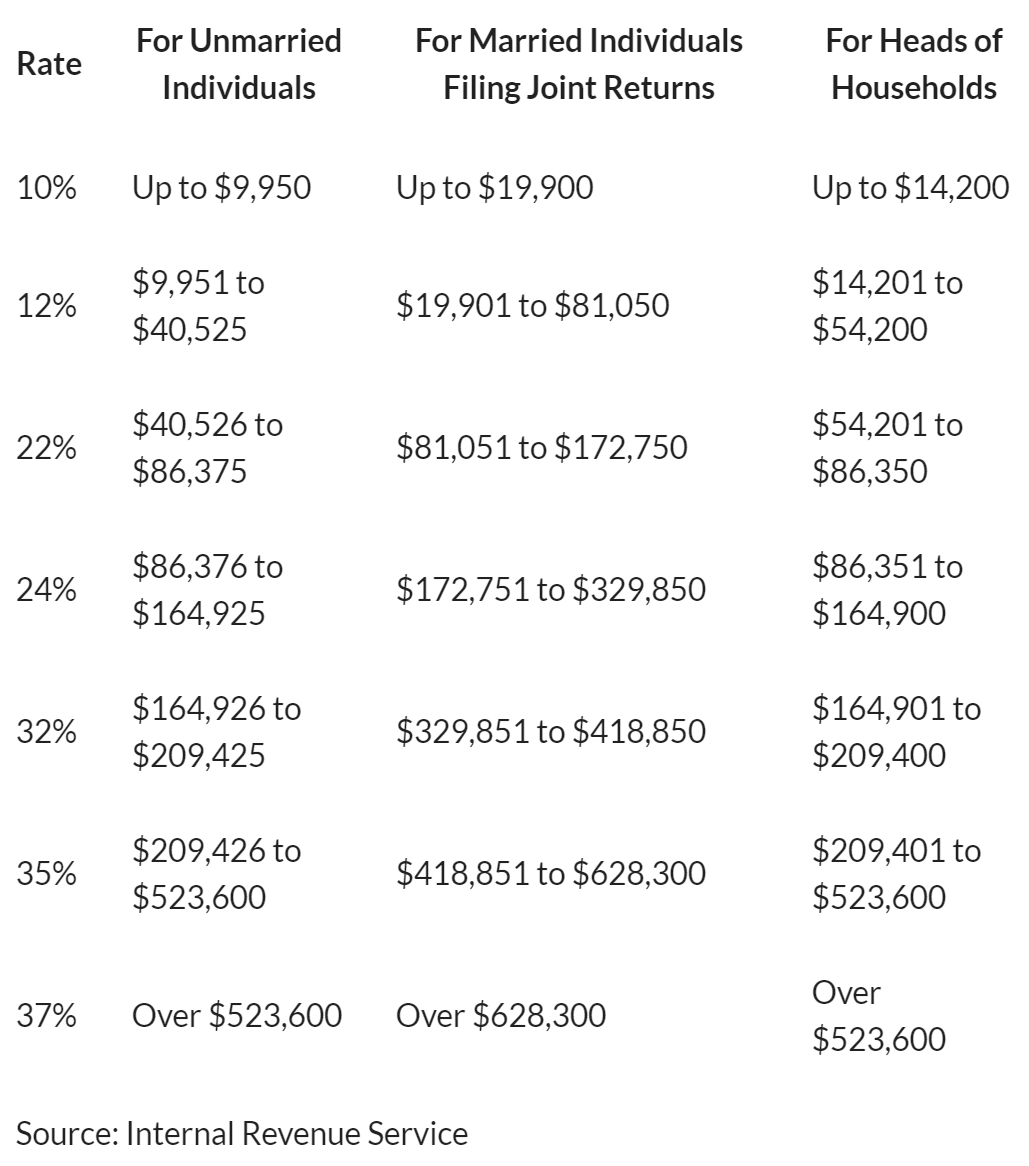

High-income earners make 170050 per year. 6 Tax Strategies for High Net Worth Individuals. Connect With a Fidelity Advisor Today.

You are allowed to put in. Because she stays at home she. 1441 Broadway 3rd Floor New York NY 10018.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners. The late supreme justice.

If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. Because his income is so high any extra income will be taxed at the highest rate currently at 465. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions. Its possible that you could. You may give up to 16000 32000 if you are married to as many individuals as you.

And because of that like most high income earners and business owners its costing you five six or even seven figures every year in taxes you dont need to pay. Qualified Charitable Distributions QCD 4. The current top marginal tax rate in the US is 37.

Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to benefit from the fact that any contributions made to tax-free savings. The annual gift tax exclusion gives you a way to remove assets from your taxable estate. Super Easy To Get Up and Running.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. The SECURE Act. A Solo 401k for your business delivers major opportunities for huge tax.

3 Tax Strategies For High Income Earners Pillarwm

5 Outstanding Tax Strategies For High Income Earners

3 Tax Strategies For High Income Earners Pillarwm

24 Best Personal Finance Books Budget Save Money Reduce Debt Personal Finance Books Retirement Planning How To Plan

3 Tax Strategies For High Income Earners Pillarwm

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmiam Small Business Tax Business Tax Llc Taxes

Ceci Marshall Finance Mentor On Instagram Follow Financesreimagined For More Finances And Wealth Building Tips

Helping Physicians And High Income Earners Take Retire With Purpose

3 Tax Strategies For High Income Earners Pillarwm

The 4 Tax Strategies For High Income Earners You Should Bookmark

Difference Between High Income Earners And Being Rich

Episode 67 Investing For High Income Earners Wealthability

Tax Strategies For High Income Earners Wiser Wealth Management

The Hierarchy Of Tax Preferenced Savings Vehicles

5 Outstanding Tax Strategies For High Income Earners

3 Tax Strategies For High Income Earners Pillarwm

Super Simple Grocery List For Two Weeks Simple Grocery List Grocery Price Book Grocery

3 Tax Strategies For High Income Earners Pillarwm

Tax Strategies For High Income Earners Wiser Wealth Management